How to Calculate the True Cost of a Cash Advance

How to calculate how much you’ll actually be paying back when you take out a cash advance

This is some text inside of a div block with Cleo CTA

CTASigning up takes 2 minutes. Scan this QR code to send the app to your phone.

Looking for a cash advance online from Cash USA? Read this first

You know the feeling. You’re all set to fly to payday. Then you’re hit with an unexpected expense. A broken-down car.

So you’re frantically googling “I need $100 now.” This is where loan companies, payday lenders and cash advance apps come in.

Despite how stressed you might be, it’s always important to do some thorough research into a company before taking their money. That includes checking out their reviews. In this case, it appears that most of CashUSA.com’s reviews suggest the company is a scam.

CashUSA claims that they can offer loans of up to $10,000 5.99% to 35.99%, on loan durations between 90 days to 72 months.

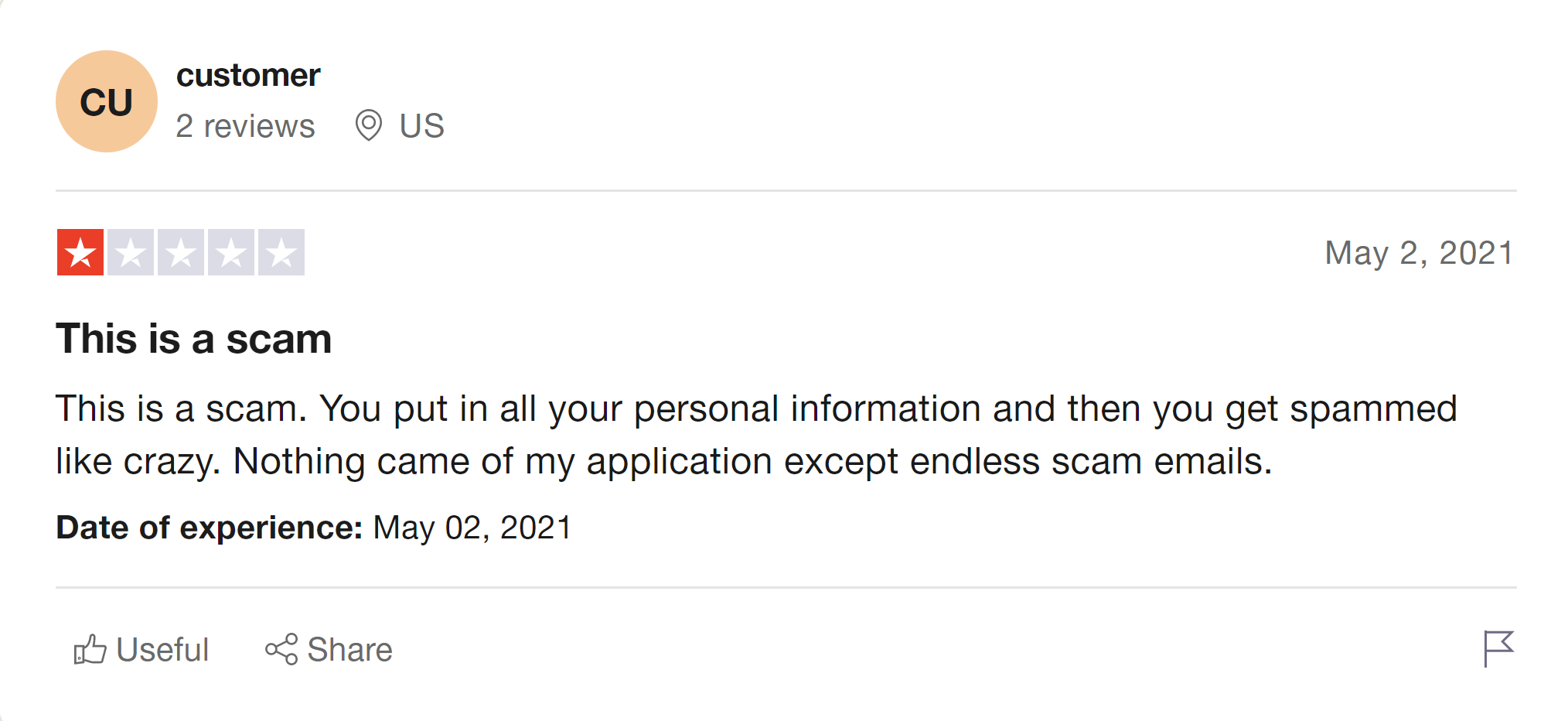

However, if you take a look at their reviews on TrustPilot, a majority of them suggest that CashUSA.com is a scam.

It’s pretty hard to find any reviews for CashUSA online. However, a quick search on TrustPilot.com shows that the company has 5 Poor reviews, which average at a score of 2.5/5.

Many of these claim that CashUSA is a data collection scam.

How to calculate how much you’ll actually be paying back when you take out a cash advance

The best apps like Dave for cash advances in 2022

Here’s everything you need to know before applying...