What I Spend In A Week: The 23 Year Old On $82,500

Plus, the easiest tips around for money hack newbies

This is some text inside of a div block with Cleo CTA

CTASigning up takes 2 minutes. Scan this QR code to send the app to your phone.

The best app to help you save money 🚀

Ever find yourself saying “how the hell did this happen” the week before payday because your checking account shows a sad $0.00?

⬆️ This. This is why budgeting is important.

You’re an adult now. It’s time to do adult things 🙃

Setting a budget is a way of making sure there’s always enough money to cover food, bills, and other essentials. Like more food.

And it can help you save.

Even if you have just a small amount of spare cash each month, every. dollar. counts.

Making a budget that works for you is all about understanding your expenses each month and having the flexibility to adapt if circumstances change.

And if you’re at that mega grown-up stage in your life where you’re starting to think about saving for a house, budgeting is a good place to start.

Budgets are different for everyone, and that’s kinda why Cleo exists.

She wants to help you make a personal budget that suits you 💖

Here's how…

Step 1 Get connected 🤝 – download the app, sign up, and connect your checking account.

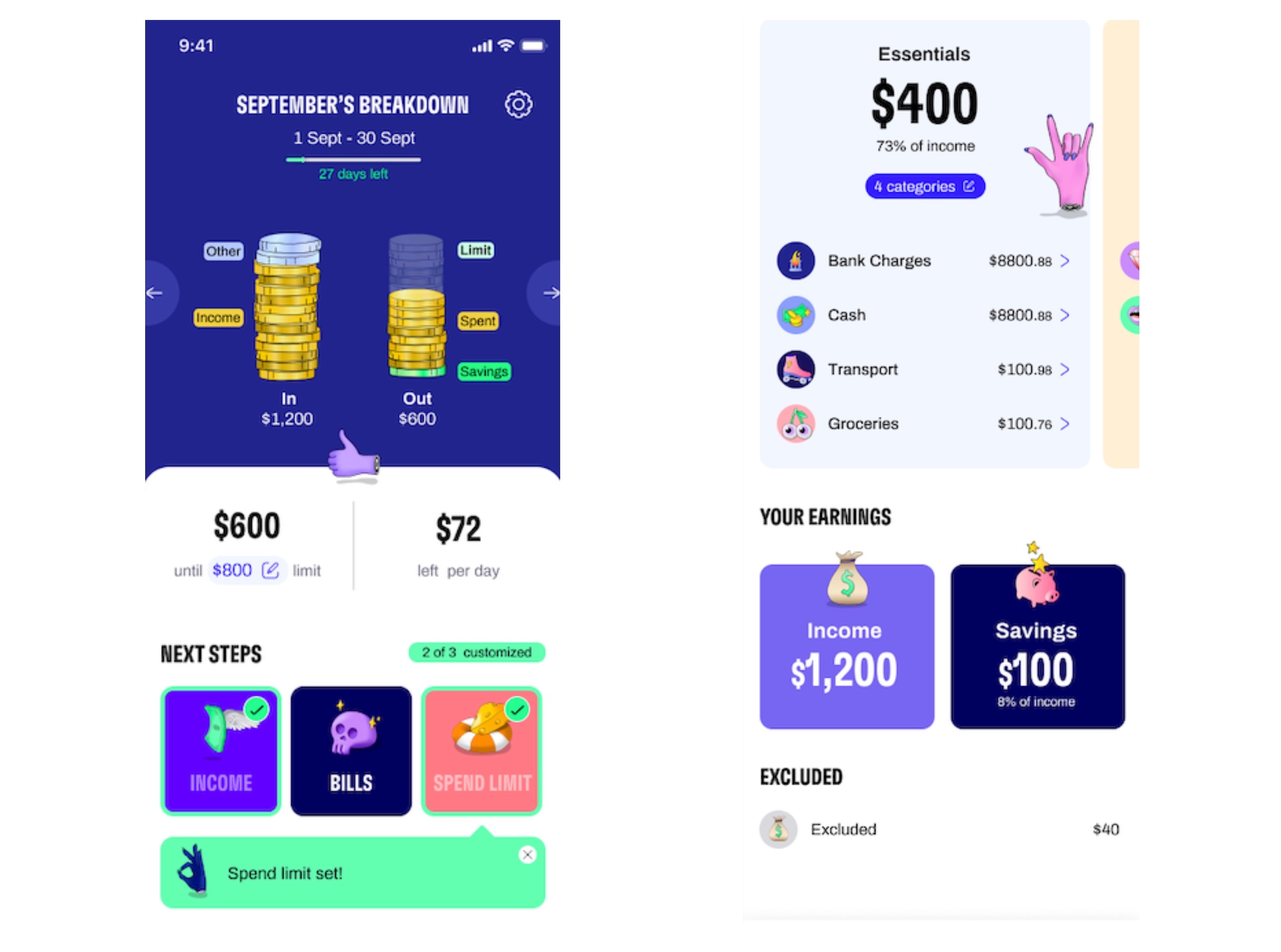

Select the Budget tab, then under Next Steps you’ll just need to tap on each icon to customize:

Step 2 Income 💸 – select your latest paycheck(s) so Cleo knows when you get paid

Step 3 Bills 👀 – add your bills and double-check to see if they’re right so they can be tracked correctly

Step 4 Spend limit 🥡 – set a realistic spend limit

🔒 Once you’re done customizing your cute budget, you’ll unlock your ‘left to spend’ and ‘left per day’ amount so you can see if you’re still able to afford your Starbucks pumpkin spice lattes. Cozy 🍂

And because we all love a visual, here’s an example of what budgeting with Cleo looks like:

Although, hopefully you won’t have $8800 in bank charges.

Cleo shows how much money you’ve got coming in and how much money you’ve got going out. She’ll show you when your bills are due and how much you’re spending on certain categories including:

Once you’ve used Cleo for a while, you’ll start to see where your money’s really going 👀

There are two options to choose from – a monthly budget or a paycheck budget.

💰 Paycheck budget:

💰 Monthly budget:

Pick the one that suits you best 🙌

Setting a spend limit is the crux of this whole budgeting thing. That’s why it’s important to set a limit you can see yourself sticking to. But if you’re new to this, don’t worry, see how the first month or so goes and then amend until it suits you.

To help ease you into the world of ✨ budgeting ✨, you could try the 50/30/20 rule:

🚃 50% of your income for needs

🍔 30% of your income for wants

🐖 20% of your income to savings and debt repayment

Any questions? Check out our gorgeous budgeting FAQs.

And if you ever go over your budget, Cleo will playfully shame you via GIFs and throw harsh burns about how much you’ve spent and how little you’ve saved. Because sometimes you need tough love 💙

Which brings us onto…

The fiery side of Cleo.

Roast mode helps put your finances in order by picking up on your bad spending habits and roasting the sh*t out of you for it (totally for educational purposes, of course).

If you aren’t already familiar with Cleo’s “big sis energy”, brace yourselves (it’s nothing personal… actually no it kinda is).

Roast mode shows you exactly where you’re going wrong (and if you’re throwing too much at capitalist overlords).

If you wanna try it out for yourself, just type “Roast me” into the chat and prepare to spend all night crying in the corner of your room.

Congrats, you’ve read a whole blog post on one of the world’s most boring (but important) subjects 🥳

As a reward for sticking with us, we’ve got 14 clever ways to save money in 2022 to help you budget like a pro.

Here’s to making better financial decisions 🏆

Enjoy this post? Give it a share or send it along to a friend. You never know, it could make a big difference.

Big love. Cleo 💙

Plus, the easiest tips around for money hack newbies

No, he doesn’t live with his parents.

This time we're talking to Chloe, who is all of the above. Chloe is a fellow coffee fiend and does virtual improv comedy classes to get through isolation. Hobbies? 10/10, but let's see how her spending ranks.