This is some text inside of a div block with Cleo CTA

CTASigning up takes 2 minutes. Scan this QR code to send the app to your phone.

It’s not great. But don’t panic yet.

Inflation sounds terrifying, especially when you don’t know what it is. And the High Priests of the Economy are great at gate keeping it.

The articles are full of jargon. The podcasts sound like whale noises. And every dude on Hinge wants to act it out for you using his Lego.

This article is none of the above. I hate Lego. And ocean creatures.

This is meant to be square one on the issue of inflation.

Inflation means rising prices.

That’s it. Things are getting more expensive. The price, if you will, is inflating.

(And you thought this had to be complicated)

For example: while online shopping, you add some quality socks to your basket. Nice wool ones.

Then you sit and watch how your checkout price changes over the years instead of living your life (tempting).

More than likely the price of those socks will go up over the years. Which is pretty normal (for reasons we’ll get into later).

More demand for stuff + limited supply of stuff = higher prices of stuff.

Now things are going to get a bit wonky. Mostly because The Experts ™ can’t agree on exactly why and how inflation happens. So if you’re not sure either, you can still become an economist.

But here’s two common examples:

People, overall, have money to spend. They buy stuff faster than companies can make it (higher demand).

So companies have to spend more to keep up. They counteract this by raising their prices.

As before, people have got the money to spend. But in this scenario, companies know they can raise their prices and won’t lose customers.

So they do just that. We all happily sip our $6 lattes. Not a care in the world except our social anxieties and ever-dwelling fear of growing old.

We knew this bit was coming. But it doesn’t hurt any less to write.

The inflation rate is at 7%. That’s the worst it’s been in 40 years. But you knew that. It’s why you’re reading this article in the first place.

It means:

Stuff this year is gonna cost you 7% more than it did last year.

People had to stay home. Factories shut down. Parts stopped being made. Shipping routes got clogged. AKA: A supply chain shortage started to brew.

While that was going on, workers all over America realized their worth and quit their corporate jobs (yeehaw). This is called the great resignation.

So now we have shortage of goods + a shortage of workers.

And then:

A lot of people saved money over lockdown.

So when restrictions eased, vaccines came about, and everyone got their third Stimmy package, people had dollar dollar bills to spend.

And the supply chain couldn’t keep up.

On a small scale, it’s like when the shirt you (and everyone else) wants is sold out. You head to Depop and find it secondhand, even if it means paying more to be the one who gets it. Now imagine it with bigger things. Like cars. People are suddenly competing for what was once just…there. So prices go up.

“Just fix the supply chain,” you might say.

Not that simple. Remember the great resignation we mentioned? That’s led to a worker shortage.

Now think back to our equation before:

More demand for stuff + limited supply of stuff = higher prices of stuff.

And sub the circumstances in:

People ready to spend post lockdown + no stuff was made in lockdown, AND the workers aren’t there to jump in and make it now = higher prices for the stuff that has been made.

It means things cost more. And that means unless you’re getting a pay raise to match inflation, it’s gonna feel like you’ve had a pay cut. So:

Stop. Re-read the headline. You’ve got the moral high ground on this one.

There is, of course, the argument that by raising wages, we’re making inflation worse (if companies have to spend more on salaries, they’ll charge more on products). On one hand, it’s technically true.

On the other hand, that’s literally something rich people say because they can afford to say it.

Meanwhile that 7% pay cut (because everything is more expensive) means going without.

So. Ask for the raise. It’s called “a cost of living adjustment” if you want to sound like you've been reading some blogs and know what you’re entitled to.

The government is worried about it and working on it.

The Federal Reserve is planning to raise interest rates in March.

What does this even mean you ask? Well you’ll have to stay tuned for another post.

But basically, they do this thing where they can influence how fast the economy grows by making debt more or less expensive.

If you’re even more confused now, that’s ok. Small steps.

Bottom line though is that nobody knows when prices will stop rising at crazy rates.

Anybody who tells you with any confidence that they know it’ll end should just head over to Twitter with the rest of the super geniuses.

Most people think end of 2022 things should go back to normal though.

If you ask your tin-foil hat Uncle, he’ll probably tell you it’s seeds and ammo time.

We’re not investment advisors but there’s some practical stuff you can do in the face of rising prices.

And look it doesn’t have to be kicking in someone’s door and taking their dog hostage. There’s more practical things like making a plan with your boss on how to get to the next level, and showing more hustle where it counts.

Giving them the finger and going where you’re appreciated is always an option too.

Ya know, we should really do another post on this. Stay tuned.

Download Cleo today to take back control of your money!

Inflation - the average rise in prices in the economy

Economy - the production and consumption activities that determine how resources are allocated. In an economy, the production and consumption of goods are used to serve those living within that economy.

Interest - the amount you’re charged when you borrow money. It’s spoken about as a percentage (interest rate).

The great resignation - a whole load of American workers quitting their jobs during the COVID-19 pandemic. Like, 4.5 million Americans quit their jobs in November 2021.

Supply chain - the steps an organization takes to deliver their products to the consumer. It’s basically going from 0 to 100.

Supply - the total amount of goods that is available to consumers.

Demand - the total amount of goods that consumers want to buy, for a set price. Prices go up when supply is less, and demand is more.

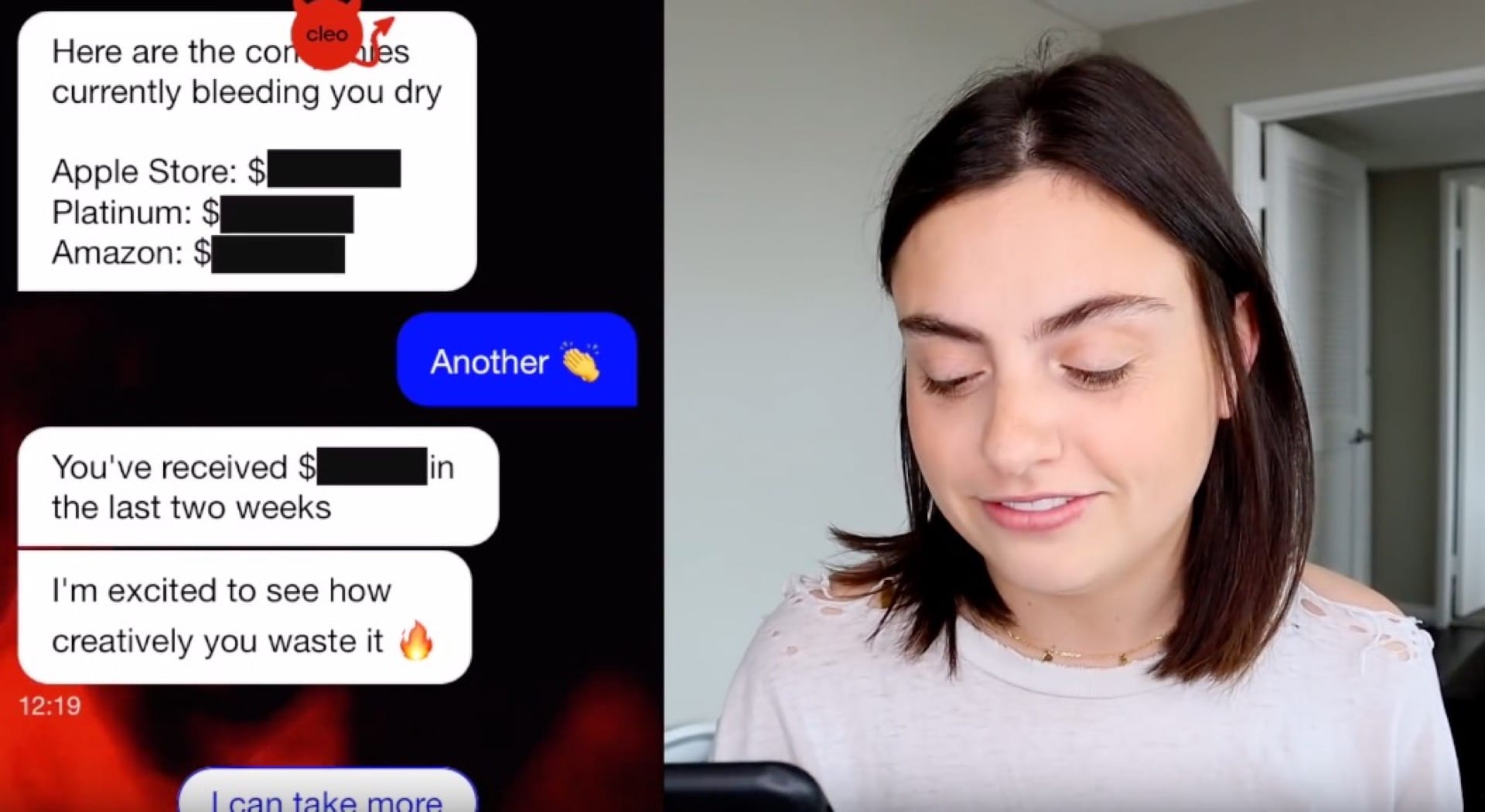

Making Amy Ordman delete Postmates

When it’s cold as fuck outside, everyone thinks about moving to Los Angeles.Los Angeles has it all: stars, palm trees, beaches… oh, and ridiculously high rents. Navigating LA on a budget can be… a challenge, to put it lightly. But not impossible.