.png)

Financial Fitness: Glow Up With These AI Budgeting Tools

Budgeting tools that'll let you spend as little time as possible thinking about your budget 🙃

This is some text inside of a div block with Cleo CTA

CTASigning up takes 2 minutes. Scan this QR code to send the app to your phone.

Excel spreadsheet budgets suck, but our money app doesn't

Gas, groceries, Netflix, rent… it’s a never-ending list.

Speaking of gas, the average price per gallon increased to $4.60 last week – making it $0.47 more than just a month ago 😬

So none of this is great. And it leaves us all feeling pretty miserable when it comes to spending.

Stuff that was already pricey now seems like it’s trying to eat us alive. It’s 8.5% more pricey this year than last, to be exact.

We wrote about the ‘why’ behind these major inflation bummers in this blog, but here I’m gonna talk about how Cleo can help you fight the good fight.

The hardest part is that we have to keep shelling out cash even though it’s a totally crap time to spend. So, what can we do to protect ourselves during this everything-is-expensive-but-I-can’t-just-stop-spending moment in history?

TF does that mean? It means, cutting back where we can and making the unavoidable spends count.

Knowing where your money’s going (and where it’s not) can give you a leg up on taking steps to cut back on things you might not need. This frees up cash to spend on the (now) more expensive (🖕) things you can’t live without.

By tracking, cutting back, and spending more intentionally, you’ll be better equipped to fight the inflatable pool toy that is our economy.

How would one get this magical insight into their daily spending? You’re reading the blog of an AI app that literally does that for free.

So while crypto and stonk bros are risking it all in digital monkey art, you can build secure spending practices with our budget app that’ll last a lifetime.

And what better time than a total market meltdown?

Fun fact, the word ‘thrifty’ doesn’t mean being cheap. It actually means, “to know the real value of something”. Interesting… right? Turns out our grandparents might be way more badass than we initially thought.

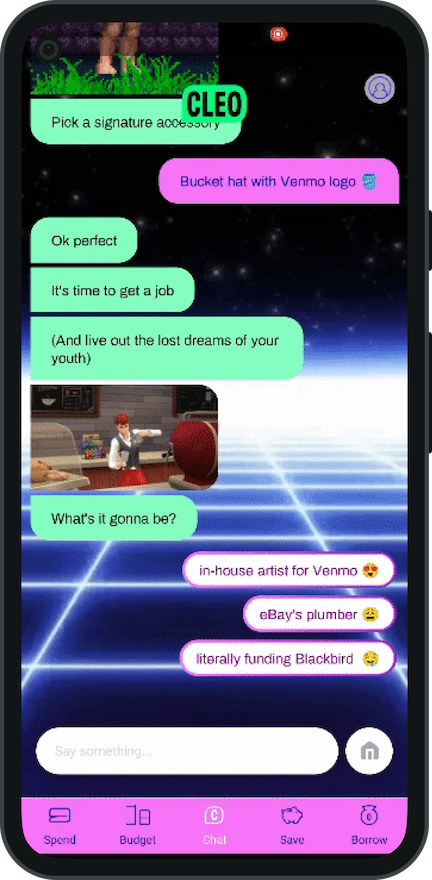

Be not afraid, Yung Spender. When you sign up to Cleo, whether you’re income-free atm or have multiple streams, Cleo’s big AI robot brain can help you budget by tracking your spending.

(We just recommend you connect the account you do most of your spending from.)

This isn’t a regular budget, it’s a cool budget. There are a few ways to go about reaping the benefits of Cleo aka the best budget app 💅

That’s right. No strict limits, no boring lists (unless you want ‘em). Just let Cleo work her magic behind the scenes to call you out on…

You just have to ˜ ~ •TURN ON YOUR NOTIFICATIONS• ~ ˜ and poof 💨

Cleo’s telling you about your money in the chat ✨

Here are some things you can say to Cleo when you get there:

💬 What did I spend on groceries this month?

💬 What are my top merchants?

💬 Help with bills

See? So easy. The best budget apps all keep things simple.

The more you tell Cleo, the more she’ll tell you about your spending habits and how much wiggle room you have. And that means you’ll have more potential to save in a time of love and Corona.

To get even more out of Cleo, tell her one (or all) of these:

Whatever option you choose, Cleo will bring your ins and outs to your attention, giving you the power to see what the hell you’re doing and what you could be doing better (she has ✨ opinions ✨).

Once you know where your money is going, Cleo can get the party started.

Cutting back is a challenge. But if it’s between cutting into non-essentials vs. rent, unless you truly dgaf, the safe choice is obvious.

The money to cover the increase in necessities has to come from somewhere. Cleo can help you figure out where. So once you see where your money is going you’ll be equipped to do some editing...

Pick one less-necessary category and cut spending there by 5%.

Just by 5%. That’s the amount experts say can make a dent in your spending enough to bring some level of relief during this inflatable mess.

To go deeper into your spends and lol at the same time, type these to Cleo in chat 💬

TIP: if there’s something you know you can’t change like student loan payments or if you don’t wanna get roasted on a specific merchant, just add it to the EXCLUDED category in the budget tab and Cleo won’t even mention it...

This sounds ultra simple because it is. It’s an effective way to protect yourself in these weird times and beyond.

So, you could do this with Cleo, or you could like… look through a long list of boring budget app transactions to compare category spending month on month. Or better yet do a sexy spreadsheet. Totally up to you!

The most important thing to remember right now is that averages exist. Over our lifetime, prices will rise and fall. It’s an impressive piece of crap out there at the moment, but it’ll calm back down.

So look for ways to preserve what you’ve got, and focus on your wins no matter how small. Luckily, Cleo can help you do both for free.

And free adjusted for inflation? Still fucking free.

Enjoy this post? Def give it a share or send it along to a friend. You never know, it could make a big difference.

Big love. Cleo 💙

.png)

Budgeting tools that'll let you spend as little time as possible thinking about your budget 🙃

Helpful tips to get you started 💸

How to make money on Pinterest for beginners