Exploring the Benefits and Risks of Credit Card Cash Advances

The pros and cons of using cash advances. Plus, an alternative option 👀

This is some text inside of a div block with Cleo CTA

CTASigning up takes 2 minutes. Scan this QR code to send the app to your phone.

Running short? Here’s how you could get a $200 cash advance before payday 💰

.png)

Klover first made an appearance back in 2019 👋

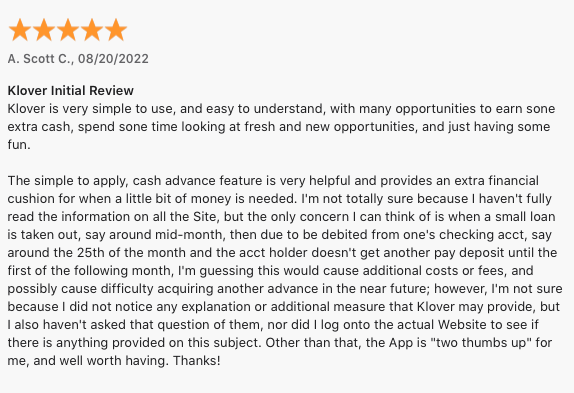

It’s a financial tech app that offers zero-interest cash advances (up to $200) to help you cover expenses until your next payday.

As well as a cash advance, you can get access to other useful financial tools. Some of which include overdraft protection and insights on your spending which should help you budget better 💅

If eligible, you can get a cash advance of up to $200 to help cover you until your next payday.

Similarly to other cash advance apps, Klover’s also a budgeting app.

With Klover, you can:

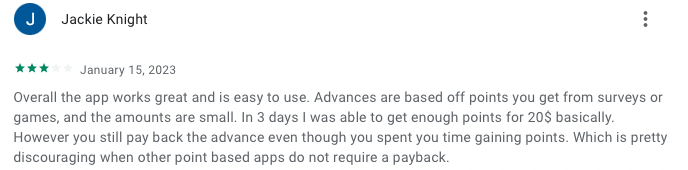

You can also earn points for completing surveys and watching ads. Easy.

You’ll then be able to cash them out to get a bigger advance or enter its daily sweepstakes 💵

The subscription is $3.99 per month.

However, if you’re looking for an instant cash advance, you’d need to pay an express fee which can be up to $9.99 🚀

💵 $0-$10 – $2.99

💵 $10.01-$25 – $3.99

💵 $25.01-$50 – $5.89

💵 $50.01-$75 – $6.49

💵 $75.01 and up – $9.99

And unlike other financial institutions (banks, we see you), if you’re unable to make the payment back on time, there’s zero interest rates and no late fees.

However, it’s important to always try to make these payments back on time as late payments can lead to poor financial habits. (Apologies for being naggy. But it’s true.)

Signing up for an account with Klover is straight forward. Firstly, you’ll just need to download the Klover app (iOS/Android).

To complete your sign-up, you’ll need the below information:

PSA: Klover doesn’t run credit checks and it doesn’t require a Social Security Number.

If you’re wondering how to get an advance on Klover, there’s a whole article on eligibility requirement. We’ve listed some of the main requirements below:

Not asking for a lot then 👀

And if you’ve recently started a new job, you’ll need to have three consistent direct deposits from your employer to qualify for a Klover advance. For most people, this would mean waiting around 6 weeks.

Klover says it keeps all of your data private. And it uses bank level, military-grade 256bit encryption technology which is one of the market’s most secure encryption methods.

Jargon decoded: Basically, yes, it’s legit. And it’s safe.

Here for it.

Klover has a rating of 4.7/5 on the App Store and 4.1/5 on Google Play.

The pros and cons of using cash advances. Plus, an alternative option 👀

Here’s how to avoid getting trapped in the payday loan cycle ❌

Here’s everything you need to know before applying...