Spain Might be Introducing Menstrual Leave — Should the U.S.?

What does menstrual health have to do with financial health? (Turns out, a lot)

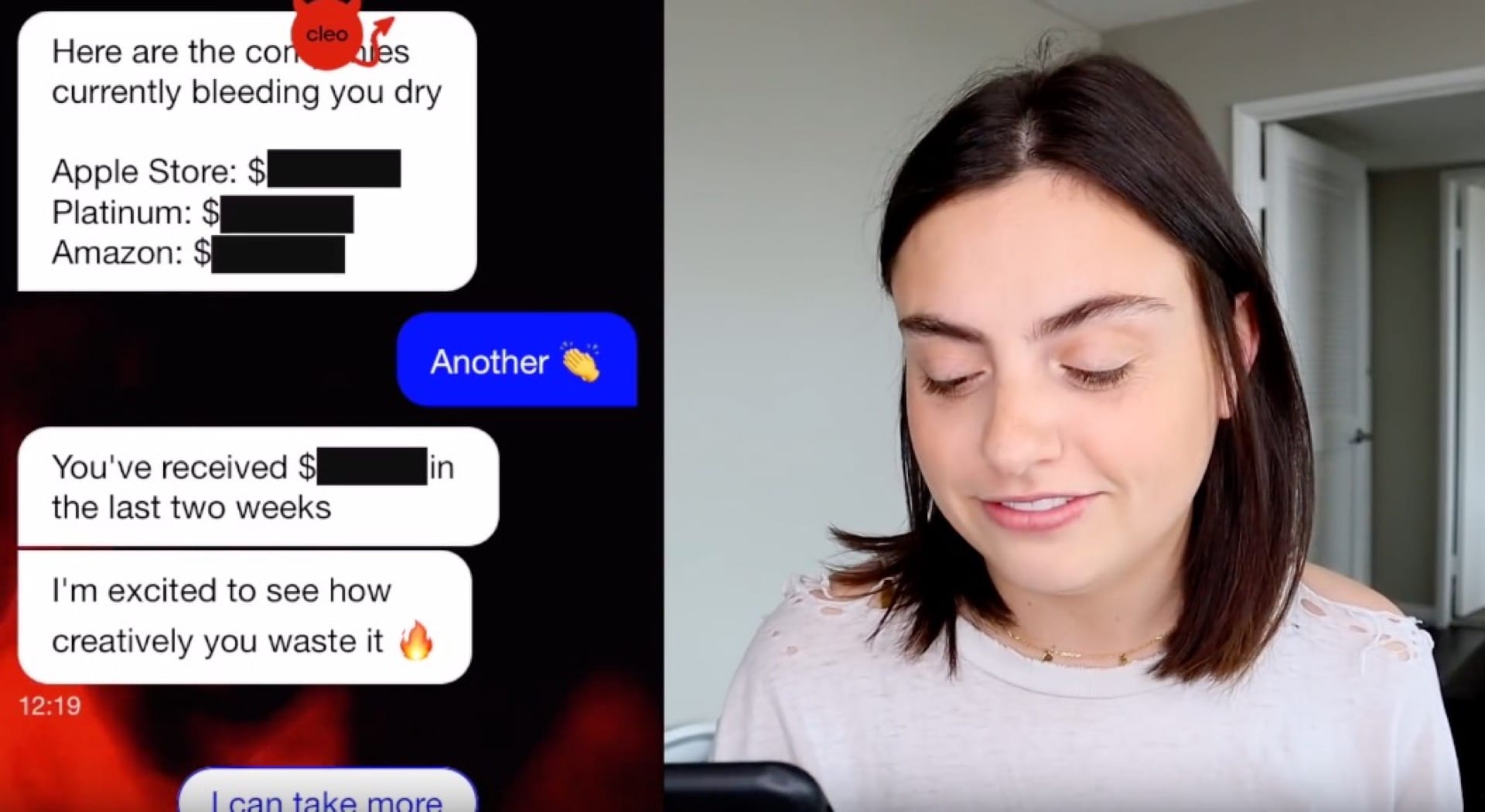

This is some text inside of a div block with Cleo CTA

CTASigning up takes 2 minutes. Scan this QR code to send the app to your phone.

Cleo's financial advisor answers your most searched questions about personal loans. Including Terms and Conditions to be aware of.

We've got Cleo's resident financial advisor, Anna, to answer some of your most-searched questions around personal loans. Including Terms and Conditions you need to be aware of.

Anna Yen, CFA, is a financial wellness expert with two decades of experience in financial markets. This includes on the trading floors of JPMorgan and as a Director at UBS. She specializes in personal finance, derivatives, and alternative investments including crypto.

Over to Anna.

Sometimes, life throws you curveballs.

Your car needs mechanical work. A cold snap shatters your water pipes and floods your house. A surprise medical bill takes out your entire last paycheck.

Whatever the cause, when life happens, sometimes it happens hard. And when these hard times come around, a personal loan can help you get back on the right track.

But before you borrow money from anyone or for any purpose, you should know what you’re getting into. That’s where we’ve got you covered.

A personal loan is a loan that you borrow to pay for expenses. Banks, credit unions, and online lenders offer this type of financing to borrowers for personal use.

Unlike auto or home loans, personal loans don’t have to be spent on a specific purpose. Essentially, as long as it’s legal, you can fund it with a personal loan.

Common uses include:

But while these loans have many uses, remember that every dollar borrowed is a dollar you have to repay later.

Personal loans are a type of installment loan repaid monthly over the loan term – anywhere from 1 to 7 years until it’s paid off. In some cases, you might get up to 10 years to repay your balance.

To get a personal loan, you first have to apply for funding. (More on that below.)

After qualifying and signing a loan agreement, you’ll receive the money in a lump sum – a single, large transfer of cash. If you’re using the money to pay off higher-interest debts, the lender may even pay those bills directly.

Lenders charge interest on personal loans, which they build into your monthly payment. Most have a fixed interest rate that stays the same until the loan is paid off. If you have a variable-rate loan, which is less common, your rate and monthly payment may change.

Over the course of the loan, your lender will likely report your payments to the credit bureaus. Making consistent, on-time payments helps build your credit history and can even boost your credit score.

Remember that you’ll have to start repaying the loan within 30-45 days of receiving funds – so it might be wise to set up automatic repayments through your bank.

To compare loan features, you’ll need to pay attention to the following features:

Exactly how much you qualify for depends on your credit score, credit history, income, and funding needs. But broadly speaking, personal loan lenders may offer anywhere from $500 to $100,000 at interest rates of 5% to 35%.

But remember: lenders may qualify you for more than you need. While it’s tempting to take the extra cash, you’ll have to repay every penny you borrow – with interest. Plus, the more you borrow, the larger your monthly payment will be, which will eat into your budget.

Generally, you’ll want to spend time researching and prequalifying for potential loans. Then, you’ll apply to (at least) your top choice, which may take an hour or less.

After that, the lender will have to approve and fund your loan. This part of the process takes the longest – anywhere from a few hours to around a week. Online lenders typically provide loan funding the fastest.

Personal loans come in two flavors: secured and unsecured.

A secured personal loan requires you to promise collateral (a valuable asset like a car or savings account) against the loan. If you can’t repay and default, the lender will take that asset to cover your unpaid debt. Secured loans reduce the lender’s risk and can help you qualify or lower your rate if you have a poor credit history.

Most personal loans are unsecured loans, meaning you don’t have to offer collateral. With an unsecured loan, the lender determines what you qualify for, as well as your interest rate, based on your finances. They may consider factors like your income, credit history, and amount of debt.

But unsecured loans can be risky. If you default on the loan, the lender can sue you to recoup their losses. They may also report the default to the credit bureaus, which will hurt your credit score.

If you’re on the hunt for a personal loan, you’ll need to apply with a lender. But before that, you might want to do some financial housekeeping.

To increase your chances of loan approval – and lower your interest rate -- you can try to improve your finances by:

Once you’ve addressed these needs, you can move on to prequalification.

To decide which lenders to apply with, you can ask lenders for the typical terms offered. You can either contact a lender like SoFi or check personal loan marketplaces like LendingTree or Credible.

After finding a few good options, you can prequalify with 3-5 lenders to see what you’re eligible for. The prequalification application generally only requires basic information like your name, address, income, and desired loan amount.

When you apply for a loan, lenders look at your financial situation and credit score to determine if you qualify.

Generally, you’ll have to provide identification and show that you have the ability to repay debt by sharing:

If the lender approves your application, they’ll let you know how much you can borrow and at what interest rate. They may propose several loan terms for you to choose from.

Bear in mind that lenders may qualify you for more than you need – but you should only borrow what you have to.

If you're short on cash, personal loans can help you fund large purchases or sudden emergencies. You can even use them to pay off higher-rate debts, such as credit card balances, and lower your long-term payments.

But before you sign on the dotted line, be sure to compare interest rates, fees, and terms offered by different lenders.

Of course, before you take on any debt, ask if you truly need it. If you can spend better and save more, you might not even need to take out a personal loan.

And if you're looking for something that'll help you budget better, we've got just the thing.

Enjoy this post? Give it a share or send it along to a friend. You never know, it could make a big difference.

Big love. Cleo 💙

What does menstrual health have to do with financial health? (Turns out, a lot)

Because we all deserve to enjoy our weekends to the full

Making Amy Ordman delete Postmates