Maximizing Your Credit Score: Building Credit Fast

Need ways to build your credit score fast? We got you ⚡

This is some text inside of a div block with Cleo CTA

CTASigning up takes 2 minutes. Scan this QR code to send the app to your phone.

Learn the basics of credit scores with Cleo. Plus, ways to build your credit score fast.

Whether you're applying for a loan, renting an apartment, or even looking for a new job, your credit score plays a huge role. In fact, credit scores affect everything down to the cost of your car insurance: in 2023, drivers with excellent credit pay about 49 percent less than drivers with poor credit. Wild.

Unfortunately, barriers to building credit for many people include:

• Not having access to information about credit scores

• Not having access to any tools to escape the bad credit cycle

So in this blog, we’re gonna cover all the basics of credit scores. Because once you understand how it works, you can start to work the system in your favor.

Let’s jump in.

A credit score reflects how reliable you are when it comes to repaying money. It’s based on how you’ve handled money in the past (like a f*cking annoying star chart). Lenders use your credit score to calculate how much risk they’re taking in lending you their product. If you’ve handled money well in the past, and made your repayments on time, lenders see you as being lower-risk. This means you can generally borrow more.

And the opposite is true. If you have a low credit score, lenders see you as high risk, meaning they will put “safety measures” in place to ensure they don’t lose money - by cranking up the interest rates, for example.

• When you take out credit, your repayment information - from merchants, lenders, landlords, etc. - is reported to credit bureaus

• A credit scoring company, such as FICO, puts together the information from these credit bureaus to make a credit score, using a certain formula (more on this further down)

• When you’re looking to use credit to make a purchase in the future, the person or company you’re purchasing from will use this information to decide what you qualify for

The concept of formal credit scoring has been around for over six decades. In the late 1950s, engineer Bill Fair and mathematician Earl Isaac created the first credit scoring system, known as the FICO score. You might’ve heard of it.

This model introduced statistical analysis into the credit evaluation process, helping lenders make more informed decisions.

Before this, forms of credit reporting had been around for literally hundreds of years. For example, merchants in the 1800s would use written credit reporting systems to decide whether potential business partners were trustworthy.

However, this method of credit reporting was based on the subjective opinions of people, which could often include racist prejudices. This kind of credit reporting, then, acted as a kind of redlining.

While credit scores are now judged on a fair scale, that doesn’t mean that the world of credit scores is an even playing field. Up to 26 million ‘credit invisible’ people struggle with a lack of credit history. Because of hundreds of years of systemic and institutional racism in America, this disproportionately affects Hispanic and Black Americans.

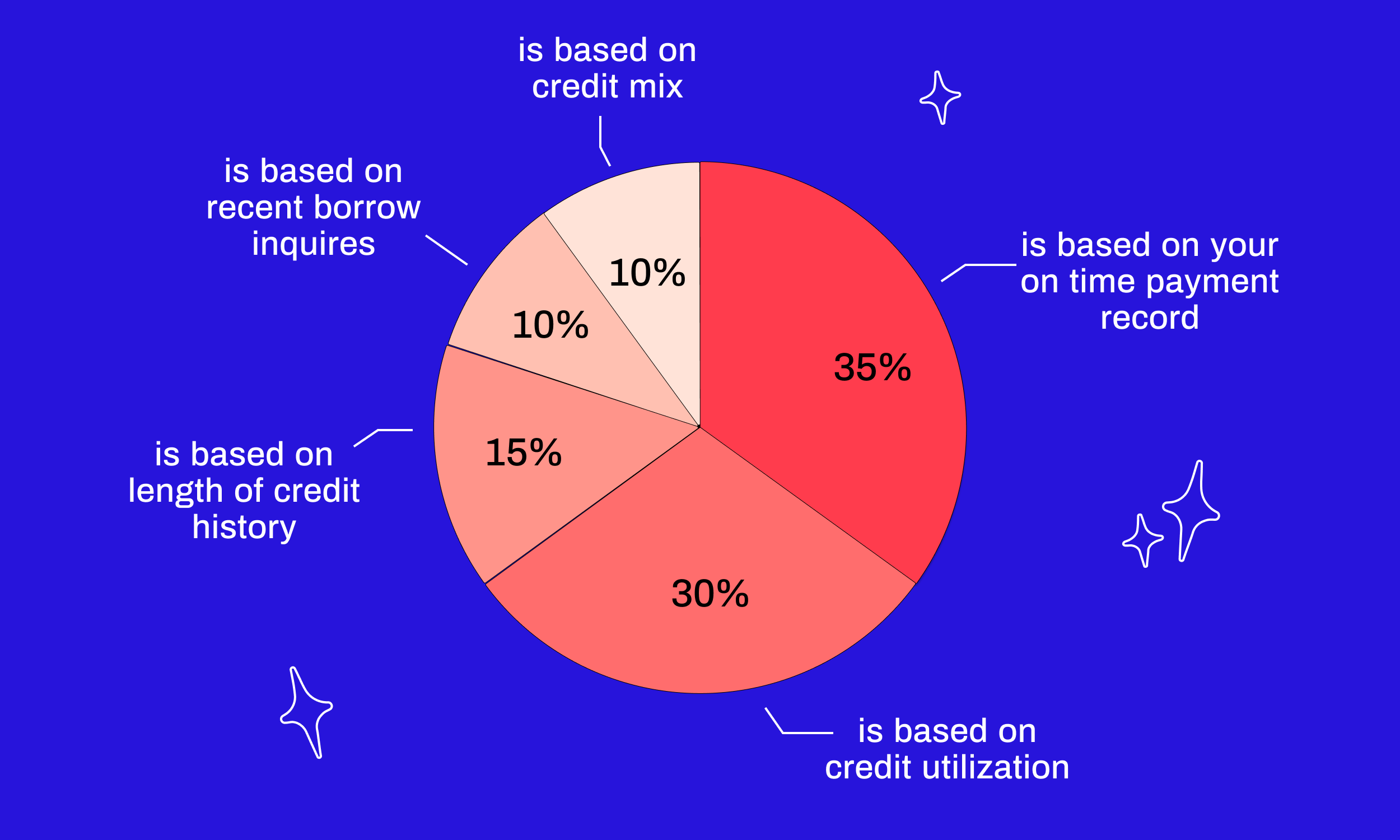

Understanding the factors that affect your credit score is essential for knowing how to build your credit. Here’s what affects your creditworthiness, according to FICO:

1. Payment history: The most important factor. Payment history accounts for about 35% of your credit score. Consistent, on-time payments positively impact your score, while late payments or defaults can significantly lower it.

2. Amounts owed: The amount of debt you owe relative to your available credit, also known as credit utilization, affects about 30% of your credit score. Keeping your credit utilization ratio low shows responsible credit management.

3. Length of credit history: The length of time you've had credit accounts for approximately 15% of your credit score. A longer credit history, with positive payment patterns, can improve your score.

4. Types of credit used: The diversity of your credit accounts makes up around 10% to your credit score. Successfully managing a mix of credit cards, loans, and other accounts can be viewed positively by lenders.

5. New credit inquiries: Applying for new credit can impact about 10% of your credit score. Multiple inquiries within a short period might raise concerns, potentially lowering your score temporarily.

According to the credit bureau Experian, it can take around 6 months to build a credit score from scratch. This is based on how long it takes to build a FICO score.

A good or excellent credit score can take longer - years. This is because a credit score is largely based on building up timely payments over a long period of time.

So, it is about playing a long game.

But there are plenty of ways to build credit fast.

Timely payments make up the majority of your credit score. Because you’re literally on the Cleo blog right now, we’ll just mention that Cleo’s free budgeting feature will create a personalized budget for you and remind you when bills need to be paid. And with the Builder subscription, you can use these timely payments to work on your score (more on that further down).

Monitoring your credit report helps you spot any errors in the report, and deal with them quickly.

Obviously. But we know there are many reasons why you might have to avoid credit cards. Like if you have a poor credit score (between 300-579), then the annual percentage rate (APR) might be way too high.

With these types of cards, you pay a security deposit which then becomes your credit limit.

The Cleo Credit Builder Card* is a type of secured card. We created it to help people fix their credit, without having to jump through a million hoops. It comes with no interest and requires no credit checks.

Here’s how it works:

💵 You add some cash to your security deposit (there’s a minimum deposit of $1). The amount of money you put in becomes your credit limit.

💵 You go shopping. You spend money on the card and then pay back the balance on time monthly. You can make this even easier by making repayment automatic with autopay.

💵 If you choose to add bills or subscriptions to these payments, you can drop some life admin and spend automatically. Bonus points for setting up bill reminders with Cleo’s free budgeting feature.

💵 Keep track of your credit score in the ‘borrow’ tab.

You’ll be able to apply for the card once you sign up for the Cleo Builder subscription, which is $14.99 per month.

With this, you get:

• The option to apply for a cash advance** of up to $270

• Priority support to help you on your credit journey

• Access to all of Cleo’s free features. Duh

Enjoy this post? Give it a share or send it along to a friend. You never know, it could make a big difference. Big love. Cleo 💙

Need ways to build your credit score fast? We got you ⚡

How to understand and master your credit score 🚦

Wondering how to fix bad credit? Or maybe you wanna know how to get a credit score. Cleo’s got you covered.