Fast Track to Stellar Credit: Top Strategies

Fast track to a stellar credit score with Cleo's top strategies for credit improvement 🚀

This is some text inside of a div block with Cleo CTA

CTASigning up takes 2 minutes. Scan this QR code to send the app to your phone.

Wondering “how can I build my credit from scratch?” We’ve got you.

.jpg)

Not having any credit can feel like you’re on the outside of an exclusive members club.

Except this members club gives you access to basic things like an apartment, a loan, or even car insurance.

Luckily, there are ways that you can build your credit from scratch.

• If you’re a young person who hasn’t had a chance to establish their credit score yet.

• If you’re a new immigrant whose credit history doesn’t transfer to their new country of residence.

• If you’ve lived a cash based lifestyle so far.

• And then there’s credit invisibility. Certain marginalized communities or underserved populations, like low-income individuals or individuals without a fixed address, might face difficulties accessing credit or may be excluded from the traditional credit system, leading to a lack of credit history.

There’s no wrong time to start your credit journey. It’s never too late or too early to get started.

.jpg)

To know how to build your credit from scratch, it’s important to understand the basics of credit.

Here are some key terms that could be useful to you:

Credit bureau: A credit bureau is an organization that keeps track of how you handle your money. They collect information about your borrowing and payment history from different sources, like banks and lenders, and create a report called a credit report.

This report helps lenders decide if they can trust you with money in the future. There are several credit bureaus, and each one collects and maintains credit information on individuals.

The Big Three credit bureaus are Equifax, Experian and TransUnion.

Credit report: A credit report is a detailed record of your financial history and how you've managed money. It shows things like the loans or credit cards you've had, if you've paid your bills on time, and if you've had any money troubles like bankruptcy.

Companies use this report to decide if they should lend you money or give you credit in the future.

Credit score: A credit score is based on the information found in your credit report. Credit reporting agencies use the data from your credit report to calculate your credit score. A credit score is a number that represents how “worthy” you are of credit and is designed to provide a quick snapshot of your credit risk to lenders.

The FICO credit score ranges from 300 to 850, with a higher score indicating better creditworthiness.

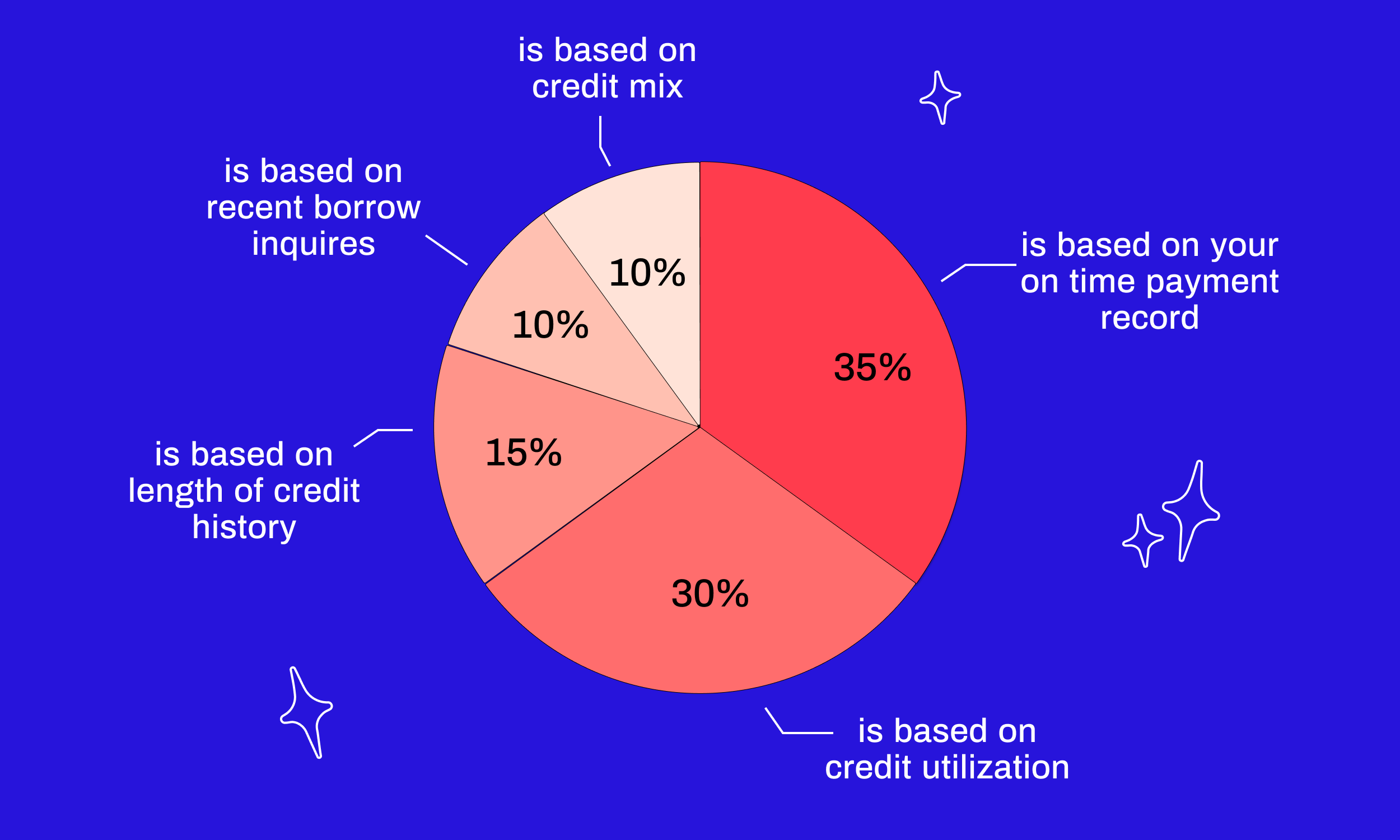

Understanding what makes up your credit score means you can use this information to your advantage to build it.

Payment History (35%): Your history of making timely payments on credit accounts, including any late payments, delinquencies, or defaults.

Credit Utilization (30%): The amount of credit you are currently using compared to your total available credit. It's generally recommended to keep your credit utilization ratio below 30%.

Length of Credit History (15%): The length of time you have had credit accounts open, including the age of your oldest account, newest account, and the average age of all accounts.

Credit Mix (10%): The variety of credit types you have, such as credit cards, loans, mortgages, etc. Having a diverse mix of credit can be beneficial.

New Credit (10%): Recent credit inquiries and newly opened accounts. Opening multiple new accounts within a short period or having numerous credit inquiries can have a negative impact.

• Always pay bills on time: Timely payments make up the majority of your credit score. Meaning, making sure your bills are always paid on time is a surefire way to begin to build credit. (We’ll just mention that with Cleo’s free budgeting features, you can get reminders when your bills are due. And, with a Cleo Builder subscription, you can use these bill payments to build credit. More on this further down.)

• Keep credit utilization low: The second most important factor in your credit score. Regularly monitor your credit card balances and make multiple payments throughout the month if needed to maintain a low credit utilization ratio.

• Monitor your score: Monitoring your credit report allows you to track your progress and see any errors or fraudulent activities. You’re entitled to one free credit report from each of the three major credit bureaus annually. Take advantage of this to check up on your reports.

This is the part where we introduce the Cleo Credit Builder Card.* It’s a secured card we designed to help people repair their credit as simply as possible. The card comes with no interest charges and no credit checks (obviously).

1. You add cash to your security deposit: Begin by depositing some cash (a minimum of $1). This makes up your credit limit.

2. Spend the money: Use the card to shop, and make sure that you pay off the balance on time each month. Here’s the hack - you can use Cleo’s free budgeting features to set up reminders for your bills. On top of this, you could pay your bills with the existing deposit to cut out some life admin. Nice.

3. Track your credit score: Monitor your credit score in Cleo's "borrow" tab to watch your progress.

To apply for the Cleo Credit Builder Card, you need to sign up for the Cleo Builder subscription, which $14.99 per month.

💙 Access to a Larger Cash Advance:** Access to cash advances of up to $270.

💙Priority Support: Get dedicated support from our team throughout your credit-building journey.

💙 Access to Free Features: Full access to all of Cleo's free features. Duh.

There’s only one thing left to do…

Enjoy this post? Give it a share or send it along to a friend. You never know, it could make a big difference. Big love. Cleo 💙

*The Credit Builder Card is issued by WebBank, Member FDIC pursuant to a license from Visa USA Inc. Access to the Card is subject to approval.

**“Cash/Salary Advance” and “Cashback Rewards” are features of the Cleo Builder Subscription and not the Credit Builder Card.

Fast track to a stellar credit score with Cleo's top strategies for credit improvement 🚀

Does increasing your credit limit affect your credit score? Here’s everything you need to know 💙

No dumb interest or credit checks involved here ✨