What's a good credit score and why should I care? 🥱

Building credit doesn't have to suck

This is some text inside of a div block with Cleo CTA

CTASigning up takes 2 minutes. Scan this QR code to send the app to your phone.

Proven methods for speeding up your growth

In the world of personal finance, an excellent credit score is like a golden ticket to…everything. From securing your dream apartment to paying 49% less for your car insurance, your credit score can impact most areas of your life.

If you’ve decided to build your credit, and you want to do it fast, don’t worry– there are sure-fire methods you can use to speed up the process.

In this article, we'll explore the fastest ways to build credit– first taking a look at what makes up your credit score, so you can understand how these credit ‘hacks’ work.

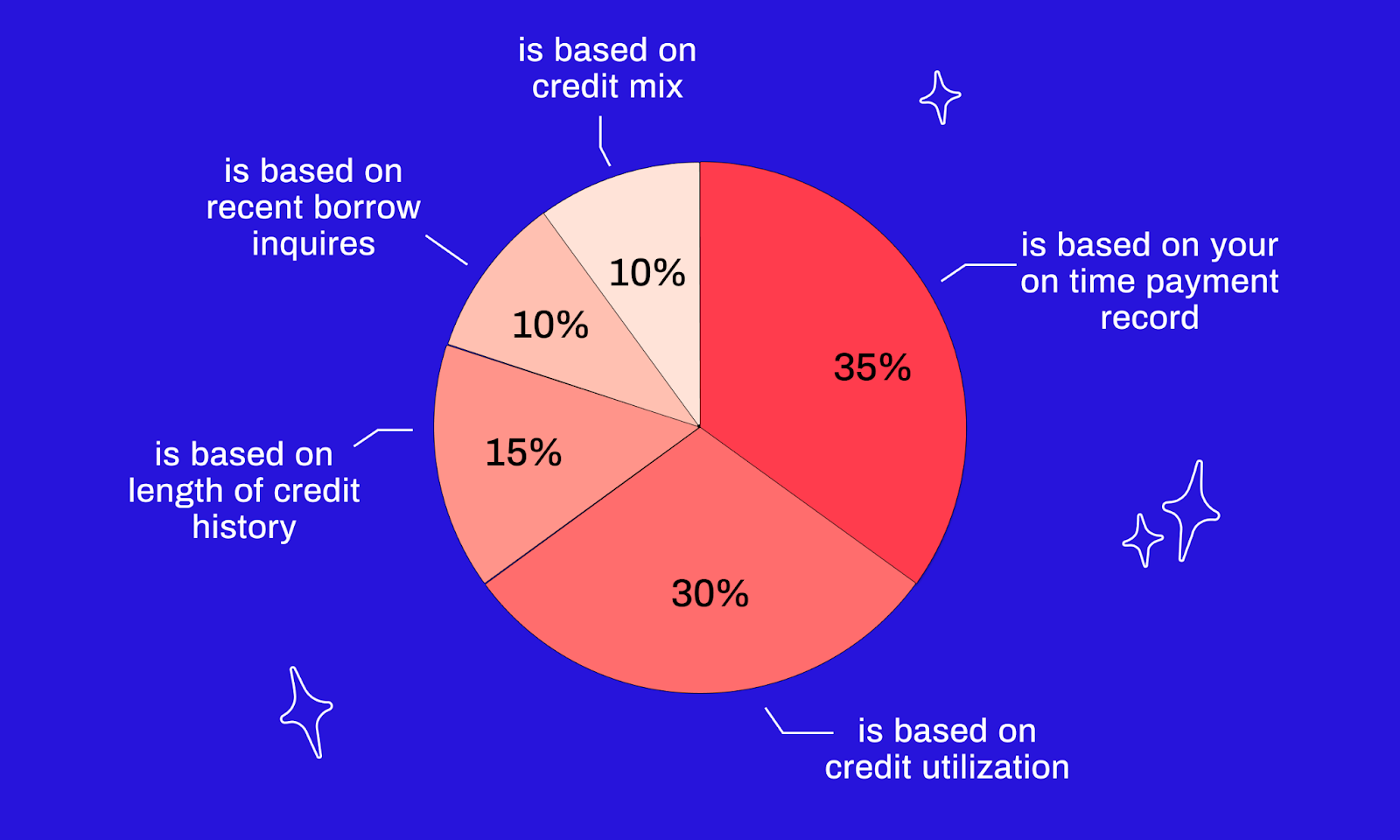

Before delving into the fastest ways to build credit, it's important to understand the fundamentals. Your credit score is a three digit number that represents how reliable you are at repaying credit. It ranges from 300 to 850. The higher your score, the more attractive you are to lenders– it’s like having a good grade in repaying money. Your credit history, payment history, types of credit, and new credit applications all contribute to this score.

Here’s what exactly makes up your credit score. This’ll help you understand the steps you can take to speed up credit building:

One of the first steps in building credit quickly is to monitor your credit report. Request a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year. Review the report for any errors, inaccuracies, or fraudulent activity that could be dragging down your score. By addressing these issues quickly, you can give your score an immediate boost.

Your payment history is a significant factor in your credit score calculation. Consistently paying your bills on time demonstrates responsible financial behavior. To make sure you never miss a due date, set up payment reminders. Timely payments are one of the fastest ways to build credit and establish a positive credit history.

PSA: Cleo’s free budgeting features can help you with this. She’ll drop you a little reminder when a bill is coming up.

Credit utilization is basically the ratio of your credit card balances to your credit limits. So, how much of your credit card you’re relying on. It’s recommended to keep your utilization below 30%.

If possible, pay down existing credit card balances and avoid making large purchases on your cards while you're working on improving your credit. Lowering your credit utilization is among the fastest ways to build credit.

If you have a trusted friend or family member with a strong credit history, you could ask them to add you as an authorized user on their credit card. Their positive payment history and credit utilization can indirectly benefit your score. Just make sure the primary cardholder practices responsible credit habits, ‘cause any negative behavior could also impact your credit.

Secured credit cards can be a powerful tool for quickly building credit, especially if you have a limited credit history or a low credit score. These cards require a security deposit, which then becomes your credit limit. Responsible use of a secured credit card, such as making small purchases and paying them off in full each month, can help you establish a positive credit history over time.

Since you’re on Cleo’s blog right now, we’ll just mention that Cleo offers a secure credit building card. The Credit Builder Card* is a secured card we designed to help people mend their credit. The card comes with no interest charges and no credit checks (obviously).

With this subscription, you get:

A Larger Cash Advance Option:** Access to cash advances of up to $270– more than what you get with a standard Cleo Plus subscription.

Priority Support: Get dedicated support throughout your credit-building journey.

Access to Free Features: Full access to all of Cleo's free features. Duh.

Credit scoring models also consider the different types of credit accounts you have, including credit cards, installment loans, and mortgages. Having a diverse mix of credit can have a positive impact on your credit score.

If you have outstanding debts that are overdue or in collections, consider negotiating with creditors to settle the accounts. Paying off or settling these debts can have a positive effect on your credit score. Keep in mind that you may be able to negotiate to have the negative information removed from your credit report in exchange for payment. Check out our article on negotiation by our resident financial advisor Anna Yen for how you can do this.

While diversifying your credit mix is beneficial, opening too many new accounts in a short period can have a negative impact on your credit score. Each new account application generates a hard inquiry on your credit report, which can lower your score slightly. Focus on strategically opening new accounts when necessary and avoid applying for multiple credit cards or loans within a short timeframe.

Building credit doesn't happen overnight. It’s a long game. But with patience and persistence, you can see significant improvements over time. Consistently applying the fastest ways to build credit, such as paying bills on time, reducing credit utilization, and diversifying your credit mix, will gradually lead to a stronger credit score. Think about what you’re excited to access when your credit score improves, and hold onto that goal. You’ve got this.

Enjoy this post? Give it a share or send it along to a friend. You never know, it could make a big difference. Big love. Cleo 💙

*The Credit Builder Card is issued by WebBank, Member FDIC pursuant to a license from Visa USA Inc. Access to the Card is subject to approval.

**“Cash/Salary Advance” and “Cashback Rewards” are features of the Cleo Builder Subscription and not the Credit Builder Card.

Building credit doesn't have to suck

Start now for future you 🚀

.jpg)

Wondering “how can I build my credit from scratch?” We’ve got you.