%20(1).png)

7 Ways To Build Credit As A Student

Trade in your sunday scaries for good credit energy 🌈

This is some text inside of a div block with Cleo CTA

CTASigning up takes 2 minutes. Scan this QR code to send the app to your phone.

How to build your credit score fast with Cleo.

Credit scores affect virtually every part of your life: from getting an apartment to applying for your dream job. In fact, credit even affects the price of your car insurance - in 2023, drivers with excellent credit pay about 49 percent less than drivers with poor credit.

It’s pretty intense. But whatever you’re working towards, there are ways that you can build your credit score fast.

In this article, we’ll take a look at the strategies and tools Cleo will give you access to, to help you build your credit score fast. But before diving into the details, let's cover the basics of credit scores.

Your credit score basically reflects your reliability in repaying borrowed money. It’s based on your past financial behavior. Lenders use this score to evaluate the level of risk involved in lending to you. If you have consistently managed your finances and made timely repayments, lenders see you as a low-risk borrower, allowing you to borrow larger amounts.

On the other hand, a low credit score signifies a “high-risk” borrower. Lenders use “safety measures” to protect themselves from potential losses, such as by whacking up the interest rates.

Here's how the process works:

1. Credit-related information from various sources - merchants, lenders, and landlords - is reported to credit bureaus.

2. Credit scoring companies like FICO compile this information using a specific formula to generate a credit score (like a really f*cking annoying star chart)

3. When you go to use credit for a purchase in the future, the seller or service provider uses this credit score to decide your eligibility.

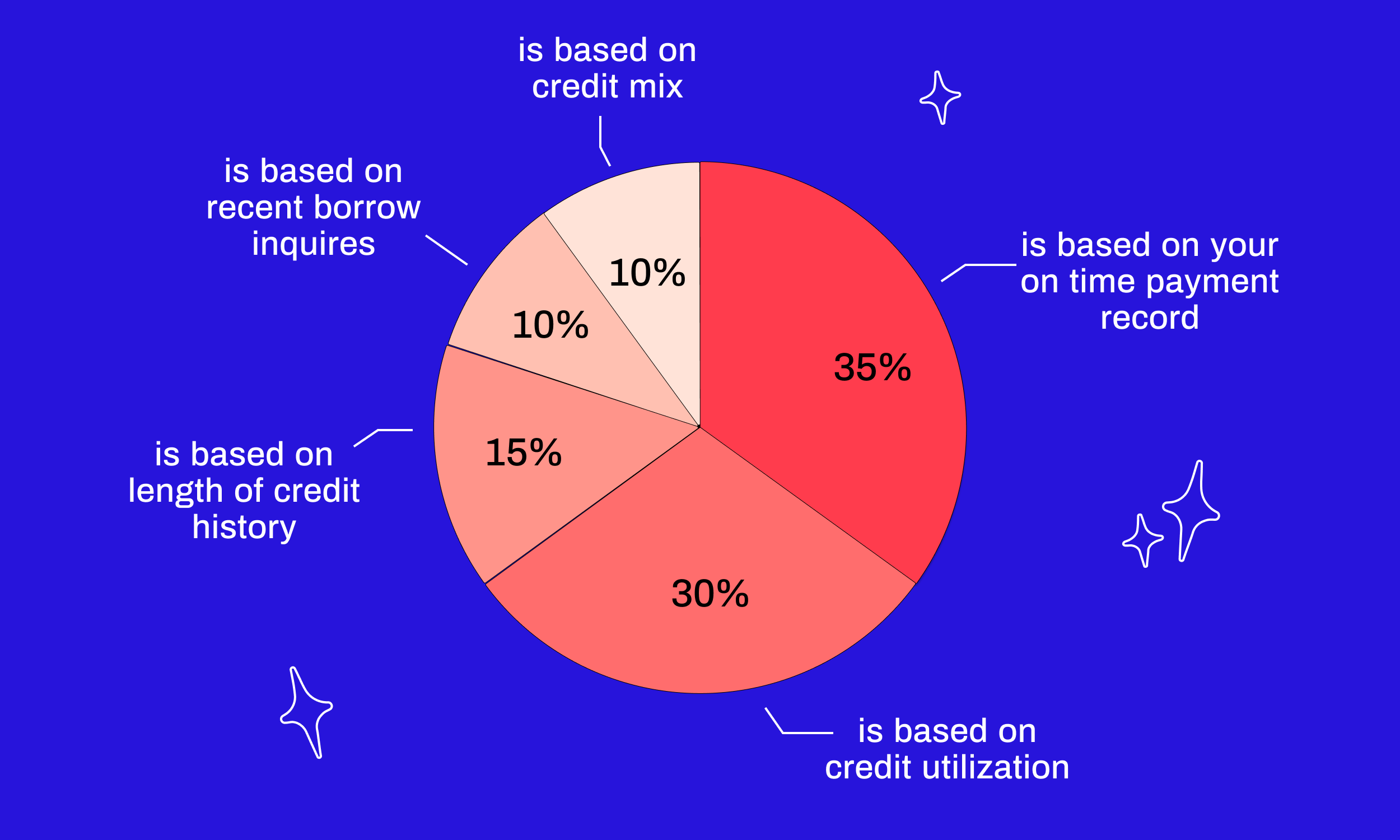

Understanding the factors that impact your credit score is super important for effectively building your credit. You might be surprised about what factors have the most impact.

Here are the key elements that affect your creditworthiness:

Payment History (35%): The most important factor - your payment history significantly influences your credit score. Consistently making timely payments has a positive impact, while late payments or defaults can drastically lower your score.

Credit Utilization (30%): The amount of credit you are currently using compared to your total available credit. It's generally recommended to keep your credit utilization ratio below 30%.

Length of Credit History (15%): The length of time you have held credit accounts for approximately 15% of your credit score. A longer credit history with positive payment patterns can improve your score.

Types of Credit Used (10%): The diversity of your credit accounts contributes around 10% to your credit score. Successfully managing a mix of credit cards, loans, and other accounts is viewed positively by lenders.

New Credit Inquiries (10%): Applying for new credit can impact approximately 10% of your credit score. Multiple inquiries within a short period may raise concerns and temporarily lower your score.

According to Experian, it typically takes around six months to build a credit score from scratch, based on the time required to establish a FICO score. Achieving a good or excellent credit score may take even longer, as it relies on consistently making timely payments over an extended period.

Don’t worry, though, there are a couple of ways you can speed up the credit-building process:

Timely Bill Payments: Always pay your bills on time. It sounds small, but they make up a significant portion of your credit score. (We’ll just mention that Cleo's free budgeting feature can help you create a personalized budget and send reminders for bill payments. And, Cleo's Builder subscription lets you use these timely payments to improve your credit score).

Credit Report Monitoring: Regularly monitor your credit report to identify any errors as they occur and address them quickly - before they do any damage.

Use Credit Cards: Using a credit card responsibly is an effective way of building credit. Duh. But we know that if you have a poor credit score (between 300-579), you might not be able to access a credit card because of super high annual percentage rates (APRs). In this case, a secured credit card might be a good alternative, where you provide a security deposit that becomes your credit limit.

With Cleo, you can send your credit score to boot camp with the Cleo Credit Builder Card.* It’s a secured card we designed to help people repair their credit without unnecessary complications. The card comes with no interest charges and no credit checks (obviously).

Here's how simple it is:

Add Cash to Security Deposit: Begin by depositing some cash (a minimum of $1) to establish your credit limit.

Make Purchases and Timely Repayments: Use the card to shop, and make sure that you pay off the balance on time each month. Life hack - you can use Cleo’s free budgeting features to set up reminders for bills and make repayments automatic with autopay.

Track Your Credit Score: Monitor your credit score in Cleo's "borrow" tab to watch your progress.

To apply for the Cleo Credit Builder* Card, you need to sign up for the Cleo Builder* subscription, which $14.99 per month.

With this subscription, you get:

Cash Advance Option:** Access to cash advances of up to $250***.

Priority Support: Get dedicated support throughout your credit-building journey.

Access to Free Features: Full access to all of Cleo's free features. Yw.

There’s only one thing left to do…

Enjoy this post? Give it a share or send it along to a friend. You never know, it could make a big difference. Big love. Cleo 💙

*The Credit Builder Card is issued by WebBank, Member FDIC pursuant to a license from Visa USA Inc. Access to the Card is subject to approval.

**“Cash/Salary Advance” and “Cashback Rewards” are features of the Cleo Builder Subscription and not the Credit Builder Card.

***Subject to eligibility. Amounts range from $20-$250, and $20-$100 for first-time users. Amounts subject to change. Same day transfers subject to express fees.

%20(1).png)

Trade in your sunday scaries for good credit energy 🌈

Does paying rent on time build credit? Yes, it can, but it doesn’t happen automatically

Fast track to a stellar credit score with Cleo's top strategies for credit improvement 🚀